Pump and dump schemes within the stock market have been around for decades. And even though cryptocurrency is relatively new, they are subjected to the same old types of scams like the pump and dump scam. Pump-and-dump schemes are alive and kicking in the cryptocurrency market due to their unregulated nature, and scammers don’t easily get caught. 2021 has been a busy year for cryptocurrency scams and crypto investors should remember that many cryptocurrencies are vulnerable to crypto pump-and-dump schemes.

Cryptocurrency pump-and-dump schemes take advantage of people and FOMO (fear of missing out), while scammers generate big profits. Often pump-and-dump schemes involve influencers who are given financial incentives to tell followers to purchase a certain digital coin, so the value of the coin is raised.

Pump and dump groups communicate on encrypted messaging services like Discord and Telegram, where groups can have several thousand members who can enter upon invitation. In these group chats, the scammers will promote a digital coin and announce it open for purchase, after buying assets themselves. After the announcement, other group members invest in the coin and talk about the coin on social media, blogs, and sometimes even on reputable media channels through paid-for sponsored content. This creates hype, which increases the price of the coin. Once the price is high enough, the initiators of the pump sell their assets, followed by other group members, which causes the price to collapse. This leaves investors who invested after the price surge with big losses, and the scammers gain huge profits.

Pump and dump groups communicate on encrypted messaging services like Discord and Telegram, where groups can have several thousand members who can enter upon invitation. In these group chats, the scammers will promote a digital coin and announce it open for purchase, after buying assets themselves. After the announcement, other group members invest in the coin and talk about the coin on social media, blogs, and sometimes even on reputable media channels through paid-for sponsored content. This creates hype, which increases the price of the coin. Once the price is high enough, the initiators of the pump sell their assets, followed by other group members, which causes the price to collapse. This leaves investors who invested after the price surge with big losses, and the scammers gain huge profits.

If you are unsure about a new coin, you should be careful when you see paid news articles about the coin in combination with a steep increase in social media conversation about that particular coin. This could be an indicator of a cryptocurrency pump-and-dump scheme.

Also, be wary of influencers who hardly mentioned cryptocurrency, but suddenly start promoting a coin.

If you are unsure about a new coin, you should be careful when you see paid news articles about the coin in combination with a steep increase in social media conversation about that particular coin. This could be an indicator of a cryptocurrency pump-and-dump scheme.

Also, be wary of influencers who hardly mentioned cryptocurrency, but suddenly start promoting a coin.

What is a pump and dump scheme?

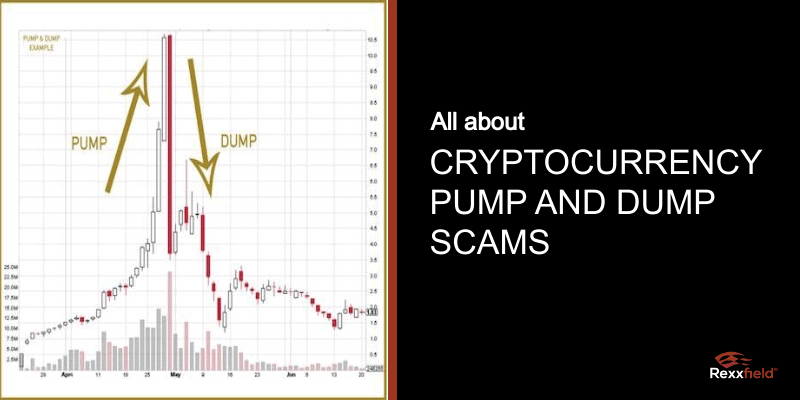

A pump-and-dump scheme usually involves stocks. Scammers generate interest in creating false hype around a stock. By doing so, investors start buying shares, which raises the price of the stock. When the price reaches a certain high, the scammers will sell all of their shares which causes the stock price to plummet and leaves new investors with a massive loss. Cryptocurrency pump-and-dump scams work pretty much the same as with stocks. The term “pumping” means the purchasing of large quantities of digital coins to create hype which raises the price of the coin.How it works:

Scammers pump a certain crypto coin to increase its value. When the value increases to a certain price, the scammers dump their coins into the FOMO they created, which results in a price crash, leaving new buyers with a lower value than the coins were purchased at. This creates significant and, in most cases, unrecoverable losses. Bitcoin is now seen as an accepted type of investment alongside other assets. It has regulated exchanges, institutional investors, and even its own futures contracts. However, many altcoins still function in an unregulated and unpredictable “wild West” environment. Almost all cryptocurrency pump-and-dump schemes target these low-capitalization cryptocurrencies because they are easily manipulated with low trading volumes. Scammers pump the price of a coin by spreading hype and fake information on social media. A common way to pump a coin is by posting in the comments section of cryptocurrency-related videos on YouTube. In the comments, scammers will hijack discussions and post comments about a digital coin they are trying to create hype around. As the comments in the image below show, the type of comment is easily recognizable. The scammers typically begin their comment with a thank you and follow with an inquiry about a certain crypto coin. They spam these comments in many channels, which creates the impression that there is genuine hype around a coin.Pumping Examples:

Source: https://bravenewcoin.com/insights/how-to-identify-a-crypto-pump-and-dump-scheme

How do you spot a cryptocurrency pump and dump before it happens?

Cryptocurrency pump and dump scams are usually easy to identify. The main giveaway is when the price of an unknown coin suddenly rises without reason. You can see this spike easily on charts like the one below. Coincheckup has set a benchmark of a 5% price increase in less than five minutes as an indicator of a crypto pump. If you are unsure about a new coin, you should be careful when you see paid news articles about the coin in combination with a steep increase in social media conversation about that particular coin. This could be an indicator of a cryptocurrency pump-and-dump scheme.

Also, be wary of influencers who hardly mentioned cryptocurrency, but suddenly start promoting a coin.

If you are unsure about a new coin, you should be careful when you see paid news articles about the coin in combination with a steep increase in social media conversation about that particular coin. This could be an indicator of a cryptocurrency pump-and-dump scheme.

Also, be wary of influencers who hardly mentioned cryptocurrency, but suddenly start promoting a coin.