Crypto Ponzi Scheme: The Tactics and Help Available for Victims

“Ponzi” is today commonly used to describe fraudulent investment schemes that are highly unstable and likely to collapse, causing significant losses for investors. The “Ponzi scheme” was named after Charles Ponzi, who was notoriously known in the 1920s for using his method to defraud people of their hard-earned money. Although the fraudsters used Ponzi schemes long before they were named as such, investors today are just as susceptible as they were to them, with promoters relying on charm, a good story and the greed of the investor to succeed in their fraud. Cyber criminals have adapted the ponzi schemes by running cryptocurrency ponzi schemes, making investors worldwide victims of a crypto ponzi scheme.

Crypto investors understand that the forward-thinking characteristics of cryptocurrency and blockchain technology are a technology evolution that can generate incredible investment gains. But the same ‘hopes and dreams’ that these opportunities promise, can also create a fertile hunting ground for a new generation of fraudsters whose promises are just as illusory as Charles Ponzi’s.

How a Crypto Ponzi Scheme Works

In a crypto Ponzi scheme, perpetrators establish fictitious cryptocurrency ventures and attract investors through fabricated narratives and false data. The unique nature of crypto makes it feasible to promote misleading profits to individuals who lack knowledge of its operations or are captivated by the potential for digital assets to yield enticing investment returns.

The Largest Ponzi Scheme Recorded

The Ponzi scheme, originally conceived in 1920, has continued to evolve alongside technological advancements. In 2008, Bernard Madoff was found guilty of orchestrating a Ponzi scheme involving fabricated trading reports that falsely depicted client profits from non-existent investments. This scheme was marketed as the “split-strike conversion” investment strategy, supposedly utilizing S&P 100 stocks and options. Madoff exploited the accessibility of historical trading data for blue-chip stocks to manipulate and fabricate his records. Subsequently, inaccurate transactions were fabricated to generate the intended periodic profit. The 2008 Global Financial Crisis led to investors withdrawing their funds from Madoff’s firm, revealing the firm’s true financial situation as it struggled with its illiquid assets. Madoff disclosed that his firm had around $50 billion in liabilities owed to about 4,800 clients. Following his conviction and sentencing to 150 years in prison with asset forfeiture amounting to $170 billion, Madoff passed away in prison on April 14, 2021.

Looking at the crypto ponzi scheme, Onecoin is the longest-running cryptocurrency ponzi scheme in the crypto industry. It was founded by Bulgarian fraudster Ruja Ignatova, also known as Cryptoqueen. Between 2014 and 2019, Onecoin attracted numerous investors by fraudulently marketing itself as a “Bitcoin Killer” and a revolutionary innovation in the crypto industry, ultimately defrauding investors of $5.8 billion. Despite their multi-level marketing incentives, Onecoin lacked a blockchain and offered a worthless coin not backed by accepted digital asset technology. Despite warnings from the U.S. government, Onecoin’s leaders faced charges only after Ignatova had gone missing. Till date, she’s nowhere to be found.

Quick Example

Consider a simple scenario in which Peter commits to delivering a 50% yield to his friend Paul. Paul entrusts Peter with a sum of $1,000, anticipating the investment to yield a value of $500 within a year. Subsequently, Peter offers the same 50% return to his friend Joy, who consents to providing Peter with a sum of $2,000. So Peter has $3,000 available, allowing him to fulfill his financial obligation to Paul by paying him $1,500. Additionally, he may decide to withdraw $500 from the collective fund for himself. He now only has $1000 left, but needs to find another $2000 to pay out Joy her principal and interest. Peter needs more investors to join so he can pay Joy, and so it continues until the money runs out.

This example plays out on a large scale in the world of crypto ponzi schemes. Scammers target the limited knowledge of investors regarding cryptocurrencies plus their personal characteristics, to leverage the appeal of crypto as an emerging technology, and its reputation for extreme and potentially lucrative gains. It is imperative to conduct thorough research when presented with a crypto investment opportunity, regardless of the perceived credibility of the promoting organization. Exercising prudence and careful consideration is the most effective method to identify warning signs and safeguard against the regrettable prevalence of investment fraud in the market.

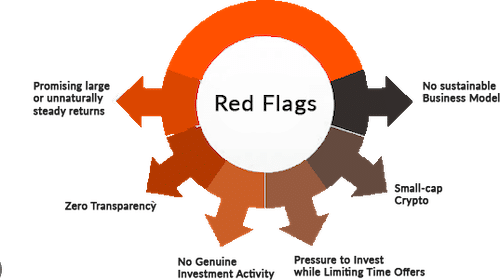

Recognize the Signs

A Promise of large or unnaturally steady returns: A defining feature of a Ponzi scheme is the commitment to delivering high investment returns, or steady returns without any volatility within a defined timeframe. Take a second and think with me, can you save $100 with your bank then expect a 300% gain in five days? In four weeks time? In six months time? Exactly, such assurances often prove to be unrealistic, serving as an initial warning sign for potential investors. The only investment that can assure you such return is the Ponzi Scheme.

Zero Transparency: Ponzi schemes often operate and dine without proper documentation, it usually gives zero clarity about the underlying investment and when they indeed give you a reason to think about their said investment, you could see zero unrealistic facts. The organizers are complex and rigid in their explanations to conceal the true nature of the scheme. By this way, it becomes difficult for investors to understand how their money is being used.

No Genuine Investment Activity: To determine a legit investment activity, one needs to consider whether the returns are derived from genuine business operations such as trading in the stock market, real estate transactions, or financial products offered by reputable institutions. In contrast, a Ponzi scheme does not involve any actual investment activity and instead relies on recruiting new investors to pay off existing ones. It is worth noting that the organizers of a Ponzi scheme may choose to abscond with the funds once a substantial amount has been invested.

Pressure to Invest while Limiting Time Offers: Fraudulent operators of Ponzi schemes frequently employ tactics that cultivate a feeling of urgency and compel prospective investors to hastily commit their resources before the purported opportunity vanishes. Looking at these manipulative tactics, they utilize time-constraining offers in order to lure individuals into making investments. They do this to cut the investors little time to thoroughly investigate the investment opportunity.

Small-cap crypto: New life has been brought into ponzi schemes due to the continual existence of small cap cryptocurrency, given that the crypto ecosystem is having a relatively low and un-diverse investment backing. The ‘gold rush’ for big returns from small, obscure tokens has been like a red rag to the bullish Ponzi merchant. Overtime, the SEC warns that the rise of unregulated selling and marketing of crypto makes it easy for scammers to entice small investors with promises of quick profits. Crypto has a reputation of high volatility, so investors are less suspicious of the promise of extraordinary returns. It’s a red flag that is hidden behind the blinding glare of the crypto ecosystem. According to blockchain tracing software group, TRM, crypto Ponzi schemes cost victims $7.8b in 2022.

No sustainable Business Model: By definition, a Ponzi scheme is financially unsustainable. The scheme requires a continuous influx of new investors to pay existing ones, it will collapse when there are not enough new investors to support the promised returns. The weight of the mass of existing investors gets heavier and heavier, meaning that like the water buildup in the Titanic, the longer it goes on, the faster the end will come..

Reporting Suspicious Activity: Be on alert for telltale signs of a Ponzi scheme:

- The returns look too good to be true, with either a) guaranteed returns, or b) high returns, low risk

- The backers are not transparent about their identity or their full track record.

- Pressure: There is a strong push to manipulate FOMO (Fear of missing out) emotionally within you.

- Delays in cashing out: Small withdrawals may be allowed at first to build trust and encourage you to invest more money. A small withdrawal does not mean you can make a large withdrawal.

- Secretive: Investment methods are kept secret

- Credibility gained through association, and not credible sources

- Unregistered investment scheme, in an unregulated domicile, unlicensed sellers.

Crypto Ponzi Scheme Investigators

If you suspect you may be caught in a Ponzi scheme, contact our crypto investigators today.

Rexxfield receives cries for help on a daily basis from people who have realized too late that they are caught in a Ponzi or other investment trap. Sadly, most will not get their money back. Prevention is far easier than the cure. However, we can in most cases trace the money, locate the scammers, and hand over the evidence to law enforcement.

Contact our crypto investigators

In conclusion, Ponzi schemes will always and continuously be a prevalent form of financial fraud. The promoter preys on individuals’ desire for quick and high returns. The blockchain and cryptocurrency ecosystem is a ‘wild west’ with many genuine opportunities, but it is also a fertile hunting ground for Ponzi fraudsters. You can protect yourself from falling victim to these fraudulent schemes by being alert to the common characteristics, undertaking proper due diligence, and not becoming susceptible to the ‘gold rush’ of easy money. The old adage still applies: “If it sounds too good to be true, it probably is.”

Author contribution: Hãmsár