Cryptocurrency is undoubtably a remarkable technology, and it seems to be here to stay, achieving a market cap of over USD$2 trillion and cementing itself into the global financial landscape. Crypto’s convenience, speed, and ability to transact internationally nearly instantly means it has been a true disrupter to financial markets. But there are two sides to every (bit)coin, and as the FBI crypto scam report outlines, cryptocurrency simultaneously presents new opportunities for criminals to exploit its characteristics for fraud.

So how big is the crypto fraud problem?

The 2023 FBI Crypto Scam Report released by the FBI’s Internet Crime Complaint Center (IC3) recently provides some insights into the scale of the problem, its growth, the extent of the financial losses, and trends.

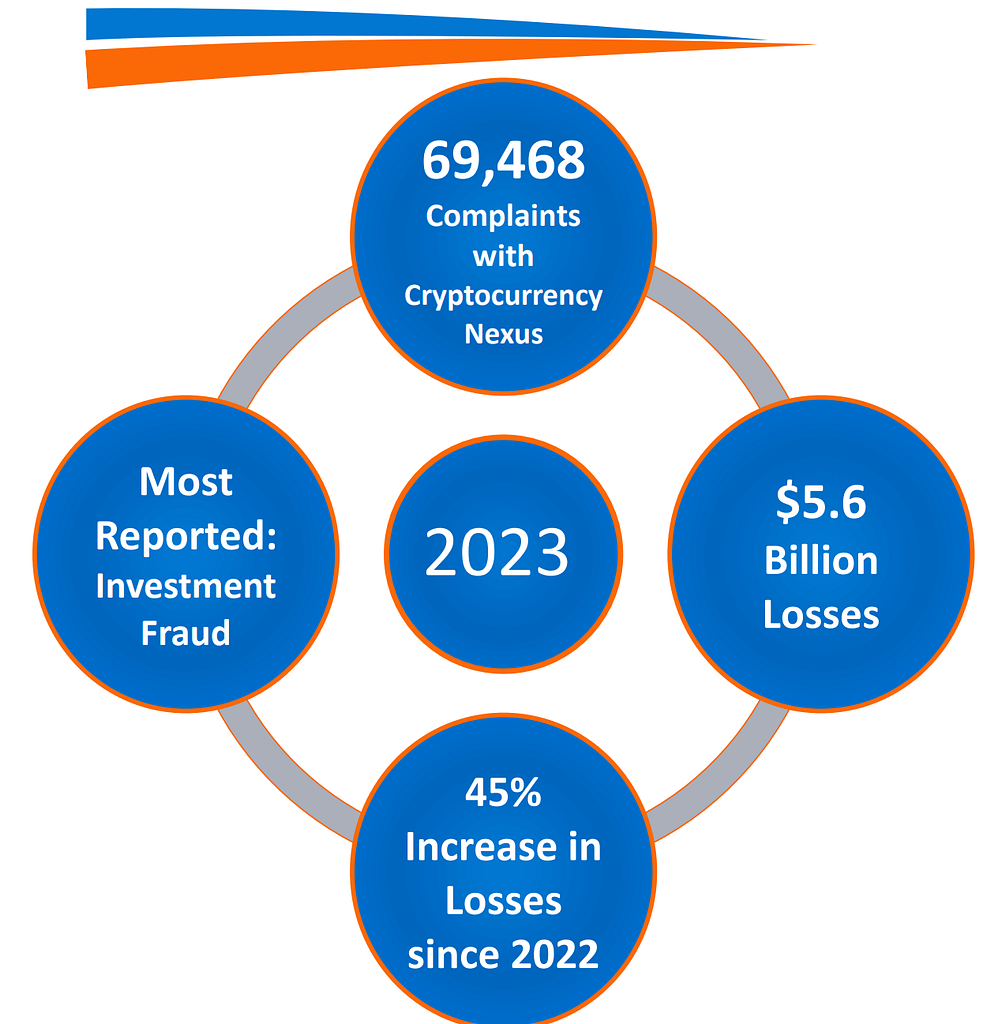

With over 69,000 reported complaints and losses amounting to $5.6 billion in 2023 alone, the data underscores the growing threat posed by cryptocurrency fraud. I’ll walk through some of the key findings of the FBI report, and add some thoughts as to how we can do better to fight crypto crime.

1. Cryptocurrency Fraud in Numbers: The Rising Tide

For 2023, the FBI crypto scam report documented a troubling surge in both the frequency and financial ramifications of cryptocurrency-related complaints:

- A total of 69,468 complaints involving cryptocurrency fraud, reflecting a significant increase compared to 2022.

- Reported losses reached an astonishing $5.6 billion, representing a 45% rise from the previous year.

- Cryptocurrency scams accounted for nearly 50% of total losses among all financial fraud complaints received by IC3, despite making up only 10% of the overall fraud complaints.

Source: FBI crypto scam report (2023)

2. Affected Demographics: Victims of All Ages

Cryptocurrency fraud impacts a wide range of demographics, with individuals from all age groups falling victim. Notably, the FBI crypto scam report indicates that those aged 60 and above experience a disproportionate share of the financial losses, amounting to significant sums:

- Individuals aged over 60 reported losses totaling $1.6 billion.

- Those in the 50-59 age bracket encountered the second-highest losses, reaching $901 million.

Interestingly, despite younger generations (ages 20-39) being more engaged in cryptocurrency markets, their financial losses are considerably lower. This likely has at least two major drivers:

- Younger people are not as asset or cash rich and so do not have the funds to invest in cryptocurrency investment schemes to the degree that middle and later aged people do, and

- Older individuals likely lack the necessary skills to identify and evade complex scams, are more trusting and less tech-savvy.

If you want to read about a real-life elder abuse scam playing out in real time (but not crypto in this case), read this story: https://rexxfield.com/the-heartbreaking-reality-of-elderly-romance-scams-a-true-story/

3. Investment Scams Predominate in the Fraud Landscape.

The FBI crypto scam report highlights the unsurprising fact that investment fraud constitutes the most prevalent form of cryptocurrency-related deception, accounting for nearly 71% of total financial losses. These scams typically offer the allure of substantial returns with minimal risk, capitalizing on the fear of missing out (FOMO) and the increasing acceptance of cryptocurrencies as viable investment options. Notable variations include:

- Confidence-based investment fraud, (also called “Romance Scams”, “Pig Butchering” scams) where perpetrators establish trust through social media or dating platforms before enticing victims into fraudulent investment schemes.

- Liquidity mining scams, which target cryptocurrency holders by persuading them to engage in fictitious liquidity pools, ultimately leading to the depletion of their wallets.

- Fake websites that are copies of legitimate exchanges or investment firms. Scam as a service has become a thing in the last few years. Scammers can buy templates of copies of real websites and pass them off as the real thing, alluring victims to login and share their primary keys with the imitation website and its controllers.

Proper and thorough due diligence significantly reduces the chances that you will become susceptible to one of these scams, because with crypto, there are rarelt any second chances. Read about the 20 most frequently asked questions about investment scams here: https://rexxfield.com/20-frequently-asked-questions-faq-on-investment-scams/

4. Fraud Beyond Investments: A Diverse Range of Schemes

Although investment frauds are the most common in the cryptocurrency sector, various other schemes are also widespread, as reported in the FBI crypto scam report:

- For example, Tech support scams are an efficient, well-funded and lucrative type of scam. It simply becomes a numbers game for tech scammers to target individuals and companies with supposed help for a tech issue.

- These scams typically work by a scammer contacting you about a supposed phone or computer issue, and as they help you to fix the ‘problem’, they install malware to capture personal information that can be used to scam you.

Tech support scams represented 13% of complaints in the FBI crypto scam report for 2023, leading to losses surpassing $420 million.

Government impersonation scams are a variation on this. In these scams, fraudsters pretend to be government officials, particularly focus on elderly individuals, contributing to a smaller yet notable share of the reported financial damages.

5. Geographic Distribution: The United States Faces the Most Severe Impact

Individuals affected by cryptocurrency fraud in the United States experienced the majority of financial losses, totaling $4.8 billion out of an overall $5.6 billion in losses. The states that reported the highest financial impacts within the U.S. included:

- California: $1.15 billion

- Texas: $411 million

- Florida: $390 million

On an international level, victims from countries such as Canada, the United Kingdom, and India also reported considerable losses, underscoring the widespread nature of cryptocurrency-related criminal activities.

6. Cryptocurrency Kiosks: An Increasingly Utilized Instrument for Fraud

The FBI crypto scam report highlights a concerning trend regarding cryptocurrency kiosks, which are being increasingly exploited in fraudulent activities. Perpetrators frequently guide victims to these kiosks to conduct anonymous transactions. In the FBI crypto scam report for 2023:

- More than 5,500 complaints were associated with scams involving cryptocurrency kiosks, resulting in losses exceeding $189 million.

- The elderly population was especially vulnerable in these schemes, with individuals over 60 suffering losses amounting to $124 million.

7. Why Do Criminals Find Cryptocurrency Appealing?

There are pros and cons for scammers to use cryptocurrency. These create opportunities for them, but also create risks that are not present in other forms of payment.

Pros for scammers:

- The inherent decentralized structure of cryptocurrency renders it particularly attractive to those engaged in criminal activities. The absence of a central authority overseeing transactions provides a significant level of anonymity (at least initially),

- Cryptocurrency facilitates rapid cross-border transfers,

- Transactions are irreversible

- The lack of international cooperation in fighting crypto makes it easy to dissapear into countries that won’t cooperate with the law enforcement who have jurisdiction over the victim

But there are cons for scammers using crypto:

- They usually need an offramp, which is typically an exchange. This is a point of risk because the exchange has their KYC and private keys for their account at the exchange – so the funds can be frozen at the exchange without the scammer knowing it

- Rexxfield recently did this with a small amount of crypto that was sitting in a non-custodial wallet.

- While it was in the wallet, we couldn’t touch it, but we were watching the wallet 24/7

- As soon as the crypto moved to an exchange, we notified the exchanges (the crypto was split between 3 exchanges). We were successful (through private-public cooperation with a European police force) to get 1/3 of the crypto frozen. Unfortunately, 2 of the exchanges did not respond fast enough and the crypto was liquidated.

- Transparency of transactions. All crypto transactions are recorded forever on the blockchain it uses. This means, through our blockchain tracing experts and tools like Chainalysis Reactor, we can ‘follow’ the money wherever it goes. If a wallet owner in the scam is identified, then the whole syndicate can come crashing down because the transactions are there for all to see.

For the rest of us, we need to take far more care around crypto, crypto investment schemes, airdrops, and our private keys. While crypto has attractive qualities, it just does not yet have the safeguards to protect inexperienced users. Make a mistake, connect to a scammer’s website, activate a malicious smart contract, and your crypto can be gone forever.

8. FBI’s Initiatives and Future Perspectives

In response to the escalating threat of crimes associated with cryptocurrency, the FBI crypto scam report boasts that the FBI established its Virtual Assets Unit (VAU) in 2022, focusing on the investigation and prosecution of offenses related to virtual assets. The VAU uses blockchain analysis tools (such as Chainalysis Reactor, that Rexxfield also uses), however, as we saw from the statistics of the rapid growth in victims and losses, it’s unlikely to be nearly enough. More is needed.

What’s the answer?

9. How we make a real dent in crypto crime: Private-Public Collaboration:

As the prevalence and intricacy of cryptocurrency-related criminal activities continue to escalate, law enforcement agencies are at last waking up to the expertise and experience that private enterprises can bring to the problem.

Rexxfield has been solving harassment and defamation-type cases since 2008, and adding cryptocurrency investigations to its solution suit in 2021, has emerged as a significant contributor in the battle against cybercrime.

Nevertheless, it is evident that neither law enforcement nor private firms can effectively address this challenge in isolation. We will lose the fight if we all work in silos in sudo-competition.

To successfully counter the rise in cryptocurrency crime, the establishment and scaling of public-private partnerships is essential.

10. The Contribution of Private Enterprises in Cryptocurrency Investigations

Private firms such as Rexxfield offer several vital arears of expertise to assist law enforcement:

- Sophisticated Forensic Technologies: Rexxfield possess access to state-of-the-art proprietary technologies that enable thorough investigations of cryptocurrency transactions and identification of identity and location of perpetrators.

- Experience: Rexxfield has experience, credentialed and qualified blockchain tracing specialists who work full-time on tracing cryptocurrency fraud.

- Blockchain expertise: Rexxfield uses the same blockchain tracing tools used by the FBI, and Rexxfield’s partnership with Chainalysis means when Rexxfield identifies wallets associated with scams, uses of Chainalysis (like law enforcement) can see it.

- Filling the gap: Rexxfield fills a gap in the resource-stretched public service. There is never enough money invested nor enough agents working crypto crime, and so Rexxfield can supplement that resource gap so more cases can be solved more quickly.

- International Scope: Cryptocurrency crime frequently transcends national boundaries, complicating the efforts of law enforcement agencies constrained by jurisdictional limitations. Rexxfield operate on a global scale, enabling us to track and investigate scams that cross borders, and facilitate cooperation between international law enforcement agencies to happen faster, without the bureaucracy and red tape that normally plagues international cooperation.

The private-public partnership is going to step up to new levels soon, with the launch of SingForce – bringing Justice at Scale (R). Watch this space for more details on Stingforce soon.

If you want to read more about the FBI crypto scam report, and in particulat business email compromise scams – which can be fiat or crypto – read more in this recent post: https://rexxfield.com/bec-scam/